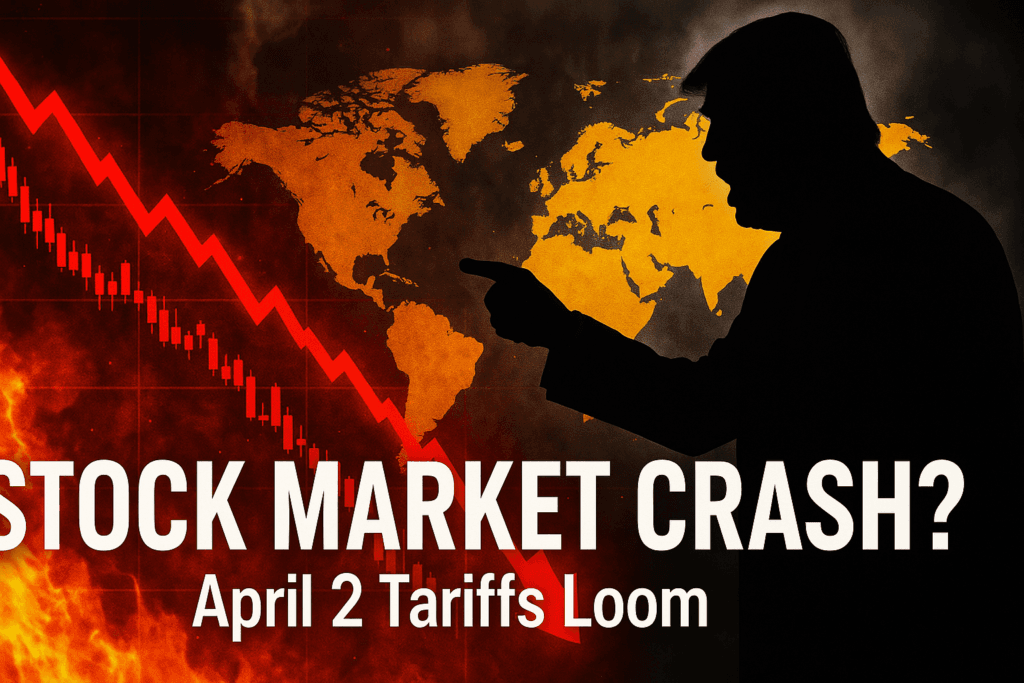

Stock Market Crash Fears Grip Asia as April 2 Approaches: Trump’s Tariffs and Global Tension

Introduction to the Market Turmoil

Hello friends I’m Harsh and, today, if you look at Asia’s major economies—Japan, China, and South Korea—one common trend stands out. As April 2 approaches, stock markets across the region are witnessing continuous sell-offs, some even teetering on the brink of a crash. This was evident today when Japan’s stock market fell by more than 4%, South Korea’s by over 3%, and even Hong Kong’s Hang Seng index saw significant declines. The American markets aren’t spared either, with stocks steadily dropping. India’s markets were closed today, so any potential downturn here will likely be visible tomorrow, April 1. But right now, everyone is anxiously waiting to see what happens on April 2.

In this article we will be looking upon stock market crash , circumstances on April 2nd and about global markets. So let’s dive deep..

Table of Contents

ALSO READ : Iran’s Secret Missile City Shocks the World | USA and Israel are Planning an attack

Trump’s Liberation Day and Reciprocal Tariffs

As you may know, Donald Trump has declared that the U.S. will celebrate “Liberation Day” on April 2. He claims this will be the day the U.S. frees itself from the “tariff trap” by imposing tariffs on every country in the world. Trump has repeatedly stated that these reciprocal tariffs, set to begin on April 2, will target literally every nation. When journalists pressed him, asking if he meant “every country in the world,” he confirmed, “Yes, we’ll start with every country and see what happens next.”

This raises a clear concern: India could also face U.S. tariffs. While India and the U.S. are still negotiating their trade deal, which might conclude around mid-2025 (possibly in the fifth or sixth month), the immediate impact of these tariffs will hit Japan, China, and, to a significant extent, India. The fear among Asian countries is twofold: selling goods to the U.S. is about to become extremely difficult, and Trump’s tariff policy might not only harm other nations but could also plunge the United States into a recession.

ALSO READ: How to Download Manus AI on Mobile?

H2: Recession Risks and Stock Market Impacts

Recently, U.S. investment bank Goldman Sachs predicted that the chances of a recession in the U.S. have now risen to 35%, up from 15%, 20%, and 25% in previous estimates. If you ask U.S. CFOs, an overwhelming majority believe a recession is inevitable before the end of 2025. When the U.S. faces a recession, its stock market typically takes a massive hit. For context, during the last recession in 2020 amid the COVID-19 pandemic, the S&P 500 dropped by 34%. In 2007, the market fell by 57%, and in 2001, it declined by 37%. On average, U.S. stock markets drop by about 31% during recessions. Historically, when American markets crash, global markets follow suit.

Whether a U.S. recession will actually happen remains uncertain. Goldman Sachs suggests there’s a 50% chance, and we can only hope it doesn’t occur, or that Trump’s tariffs won’t have a severe impact. However, Trump isn’t just talking about tariffs—he’s also issuing threats to attack Iran, promising unprecedented bombing campaigns. In response, Iran has prepared its missile launch pads, signaling readiness for conflict. This geopolitical tension is another driver behind the global market sell-off we’re witnessing.

ALSO READ : Qwen2.5-Omni: The AI That Can See, Hear, Talk, and Write

The Gold Rush Amid Uncertainty

One constant in times of uncertainty is the rise in gold prices. As investors sell off stocks and other assets, gold becomes a safe haven. Today, gold prices have surpassed $3,100 per ounce for the first time in history, reflecting the market’s nervousness.

India’s Position in the Global Turmoil

Interestingly, commentary about India remains largely positive. Several American investment banks argue that even if a U.S. recession occurs, India might initially face a shock—its stock market could dip, and GDP growth might take a hit. However, over the long term, India is expected to perform better than most countries. One key reason is that India has already begun negotiations for a trade deal with the U.S. Recently, when asked about imposing tariffs on India, Trump acknowledged that tariffs are likely but noted that trade deal talks are ongoing. He praised Prime Minister Modi, calling him “smart” and “great,” suggesting that India’s growth story remains intact in the long run.

ALSO READ : OpenAI’s New Ghibli Art Feature: Turn Photos into Studio Ghibli Magic

What April 2 Means for Global Markets?

April 2, dubbed “Liberation Day” by Trump, is shaping up to be a pivotal event. Not just Asian markets but European and global markets will react to the U.S.’s move to become a reciprocal tariff-imposing country for the first time in decades. I’ll keep you updated on developments related to this. My advice? Stay safe and avoid risky moves.