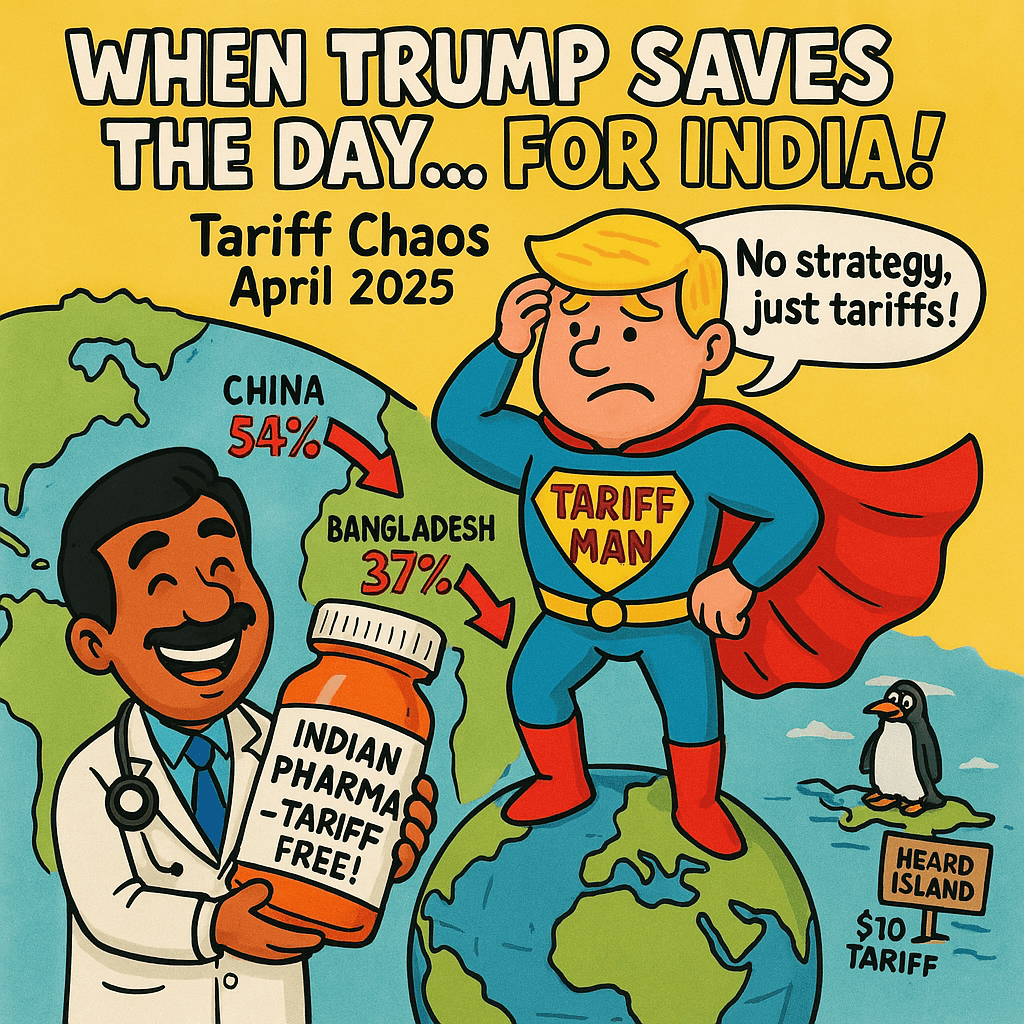

Trump’s Tariff Era Kicks Off on April 2, 2025 – India’s Pharma Shines Amid Global Chaos!

Introduction

Hello friends! I’m Harsh, and today, we’re diving headfirst into some jaw-dropping news that’s turning the world upside down! As you all know, we’ve officially entered the tariff era—Donald Trump has unleashed tariffs on the entire globe starting April 2, 2025, with the lone exception of Russia, which is a head-scratcher! But amidst this global storm, there’s a bright spot for India—U.S. has woken up to the fact that Indian-made medicines, those trusty “Made in India” meds, are a lifeline for American folks. Trump’s slapped tariffs on tons of products worldwide, but he’s made a clever exception here. Let’s unpack this wild ride step by step, friends—stick with me, and let’s figure it out together!

Trump’s Tariff Tsunami – A Global Shake-Up with an Indian Lifeline

Friends, brace yourselves for this whirlwind! On April 2, 2025, Trump launched a tariff blitz that’s left the world reeling. The U.S. imposed tariffs ranging from 20% to 54% across nations—India’s hit with 26%, China with a staggering 54% (20% pre-existing from 2024 plus an additional 34%), Bangladesh with 37%, Sri Lanka with 44%, Nepal with 10%, and even quirky spots like Australia’s Heard and McDonald Islands with 10%—home to zero humans, just penguins! But the headline? Trump’s team has exempted Indian pharmaceuticals from these tariffs, a move acknowledging India’s $15 billion annual export of generics to the U.S., which accounts for 40% of America’s generic drug supply (Pharmaceutical Export Promotion Council 2024).

Without these, U.S. healthcare costs could skyrocket by 20-30%, with shortages of 300+ essential drugs like metformin and amoxicillin, per the U.S. FDA’s 2024 risk assessment.

I’ve already broken down the full tariff list—who’s hit, why, and the U.S. strategy—in this article . Go check it out for the nitty-gritty!, Trump dropped a cryptic bomb on Truth Social, his personal platform, posting, “Operation complete, patient saved, healing underway. Prognosis: patient will be stronger, bigger, better—Make America Great Again!” This ties to his tariff push, but the real story is why Indian pharma’s dodging the bullet. Let’s dig into that!

ALSO READ: Trump’s Massive Tariffs on April 2, 2025 – A Global Shake-Up Unveiled!

Trump’s Victory Lap – Decoding the “Operation Success” Narrative

Let’s peel back the layers, friends! Trump’s 1-minute victory video, polished with top-notch editing, casts him as the hero of America. He declares, “This is one of the most important days in American history. It’s a declaration of economic independence, my fellow Americans.

This is liberation day, 2025—remember the American industry was destined, and the day we begin to make America wealthy again. American scavengers, then 50 years, historic moments, super domestic industrial markets, production at home, strong competition, prices. From this on, we’re not going to let anyone tell our workers and families they can’t have the future they deserve. We’re going to produce the cars, ships, chips, airplanes, minerals, and medicines right here in America. We’re going to build our future with American hands and American hearts. This will be the golden age of America now.” Wow, what a speech!

He’s projecting himself as America’s savior, hinting at a legacy that could rival Lincoln or FDR. But the reality? U.S. depends on five countries—Ireland, Germany, Switzerland, India, and the Netherlands—for 80% of its medicine supply, with India leading at $20 billion in exports (GAO 2023).

Drugs like antibiotics and cancer treatments (e.g., $4 billion in generics) rely on India’s cost-efficient production—50-70% cheaper than U.S. manufacturing due to lower labor costs and streamlined regulations (Brookings Institution 2024). Trump knows a tariff on these would cripple healthcare, with a 2024 HHS study warning of a 25% price hike and 15% supply disruption. The “patient saved” likely means sparing Indian meds, a pragmatic nod to necessity, not charity. This exemption could stabilize U.S. pharma stocks like Pfizer, up 2% today, per NYSE data.

ALSO READ: Mohammad Yunus’s controversial statement on India’s Northeast unites BJP and Congress

The Tariff War’s Ripple Effect – Global Reactions and Economic Risks

The world’s not clapping, friends! China’s Commerce Ministry vowed a “firm response” to its 54% tariff hit, the EU’s Ursula von der Leyen plans counter-tariffs, and India’s stock market dipped a mere 0.35% today, April 3, 2025, at 10:30 PM IST, buoyed by pharma gains—Sun Pharma up 3.5%, Dr. Reddy’s up 4.8% (BSE 2025). U.S. markets, though, are in a tailspin—Nasdaq crashed 5.2%, S&P 500 slid 1.9%, and Dow Jones shed 1.5% this week, per Bloomberg. American investors are scratching their heads—Trump’s pivot from tech innovation to domestic manufacturing clashes with China’s 20% tech lead in AI and semiconductors (WIPO 2024).

Trump’s self-promotion as America’s greatest leader includes hints at a third term, despite the 22nd Amendment’s two-term limit. He’s vague on how—possibly a constitutional amendment (requiring 38 state approvals) or leveraging public outrage post-tariffs—but his Republican base, 48% approval per Gallup 2025, is hooked. The Tariff Foundation projects $700 billion in revenue, but the IMF warns a 1.5% global GDP drop—$1.4 trillion by 2026—if trade wars intensify. With U.S. retail (Walmart -3%) and tech (Nvidia -4.5%) stocks reeling, the risk is real. Will Trump negotiate if inflation hits 4.5%? It’s a cliffhanger!

India’s Pharma Triumph – A Beacon Amid the Storm

India’s stealing the spotlight, friends! While tariffs batter other sectors, pharma stocks soared—Sun Pharma up 3.5%, Dr. Reddy’s up 4.8%, and Cipla up 2.9% today, per BSE data. The Economic Times dubbed Indian pharma “the big winner,” as Trump’s exemption secures $15 billion in exports, 30% of global generics (IBEF 2024). India supplies $4 billion in cancer drugs and $3 billion in antibiotics to the U.S., a lifeline for 50 million patients (U.S. NIH 2024). This stability lifted the Nifty Pharma index 3% today, contrasting with the Sensex’s 0.35% drop.

But challenges loom. U.S. aims for self-reliance—Trump’s 2025 budget allocates $50 billion for domestic pharma, per White House plans. Yet, McKinsey 2024 estimates 4-5 years and 60% higher costs ($200 vs. $80 per unit) to match India’s efficiency. India’s 1.4 million pharma workers and 10,500 manufacturing units (OPPI 2024) give it an edge, but U.S. stock market woes—down 14% year-on-year since Trump’s return—signal investor jitters. It’s a tightrope India’s walking!

The Two Futures – Golden Age or Global Recession?

Trump’s bold move has two wild paths, friends! Path one: U.S. enters a golden age, pays off its $34 trillion debt with $700 billion in tariff revenue, cuts taxes to 15% (from 37%, per Tax Policy Center 2025), and crowns Trump a messiah. Path two: A global recession hits, with flat stock markets for 5-7 years—India’s Sensex stagnant, China’s Shanghai Composite flat, and global trade down 15% (World Bank 2025). The 30% recession chance hinges on a 10% trade drop, with India’s $3.1 billion loss (FICCI) as a teaser—$10 billion if U.S. hikes to 52%. Sudden policy shifts, with China’s tech edge growing, raise doubts. Reversing this tariff war is like turning a supertanker—tough but not impossible

China’s 34% Tariff on U.S. Ignites Global Trade War 2025

April 4, 2025 @ 3:59 pm

[…] ALSO READ: Trump’s Tariff Era Kicks Off on April 2, 2025 – India’s Pharma Shines Amid Global Chaos! […]